Bargain Hunter

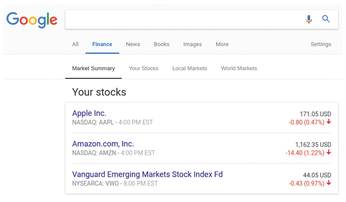

For users of stock-quote-serving APIs, the fruit is currently hanging higher. First, Google discontinued its web service [1] for real-time stock market data (Figure 1); then, Yahoo followed suit and pulled the plug. With the end of their undocumented but widely used share price interface in CSV format [2], Yahoo, perhaps unknowingly, also pulled the rug from under a number of open source projects, such as the Perl Yahoo::Finance CPAN module and the Python yahoo-finance package. A few open source portfolio-tracking applications using these popular packages were dragged into the abyss along with them.

On the GitHub sites of these projects, the Issues tabs are now overflowing with comments, there's quite a bit of wailing and gnashing of teeth from users, and much wringing of hands of those who hope to find a replacement for the vanished free real-time (or at least time-delayed) stock market price data source.

[...]

Buy this article as PDF

(incl. VAT)