Bargain Hunter

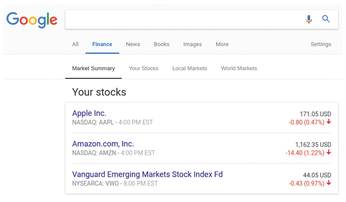

For users of stock-quote-serving APIs, the fruit is currently hanging higher. First, Google discontinued its web service [1] for real-time stock market data (Figure 1); then, Yahoo followed suit and pulled the plug. With the end of their undocumented but widely used share price interface in CSV format [2], Yahoo, perhaps unknowingly, also pulled the rug from under a number of open source projects, such as the Perl Yahoo::Finance CPAN module and the Python yahoo-finance package. A few open source portfolio-tracking applications using these popular packages were dragged into the abyss along with them.

On the GitHub sites of these projects, the Issues tabs are now overflowing with comments, there's quite a bit of wailing and gnashing of teeth from users, and much wringing of hands of those who hope to find a replacement for the vanished free real-time (or at least time-delayed) stock market price data source.

[...]

Buy this article as PDF

(incl. VAT)

Buy Linux Magazine

Subscribe to our Linux Newsletters

Find Linux and Open Source Jobs

Subscribe to our ADMIN Newsletters

Support Our Work

Linux Magazine content is made possible with support from readers like you. Please consider contributing when you’ve found an article to be beneficial.

News

-

Parrot OS Switches to KDE Plasma Desktop

Yet another distro is making the move to the KDE Plasma desktop.

-

TUXEDO Announces Gemini 17

TUXEDO Computers has released the fourth generation of its Gemini laptop with plenty of updates.

-

Two New Distros Adopt Enlightenment

MX Moksha and AV Linux 25 join ranks with Bodhi Linux and embrace the Enlightenment desktop.

-

Solus Linux 4.8 Removes Python 2

Solus Linux 4.8 has been released with the latest Linux kernel, updated desktops, and a key removal.

-

Zorin OS 18 Hits over a Million Downloads

If you doubt Linux isn't gaining popularity, you only have to look at Zorin OS's download numbers.

-

TUXEDO Computers Scraps Snapdragon X1E-Based Laptop

Due to issues with a Snapdragon CPU, TUXEDO Computers has cancelled its plans to release a laptop based on this elite hardware.

-

Debian Unleashes Debian Libre Live

Debian Libre Live keeps your machine free of proprietary software.

-

Valve Announces Pending Release of Steam Machine

Shout it to the heavens: Steam Machine, powered by Linux, is set to arrive in 2026.

-

Happy Birthday, ADMIN Magazine!

ADMIN is celebrating its 15th anniversary with issue #90.

-

Another Linux Malware Discovered

Russian hackers use Hyper-V to hide malware within Linux virtual machines.